Effortless Tax with Taxbuddy.

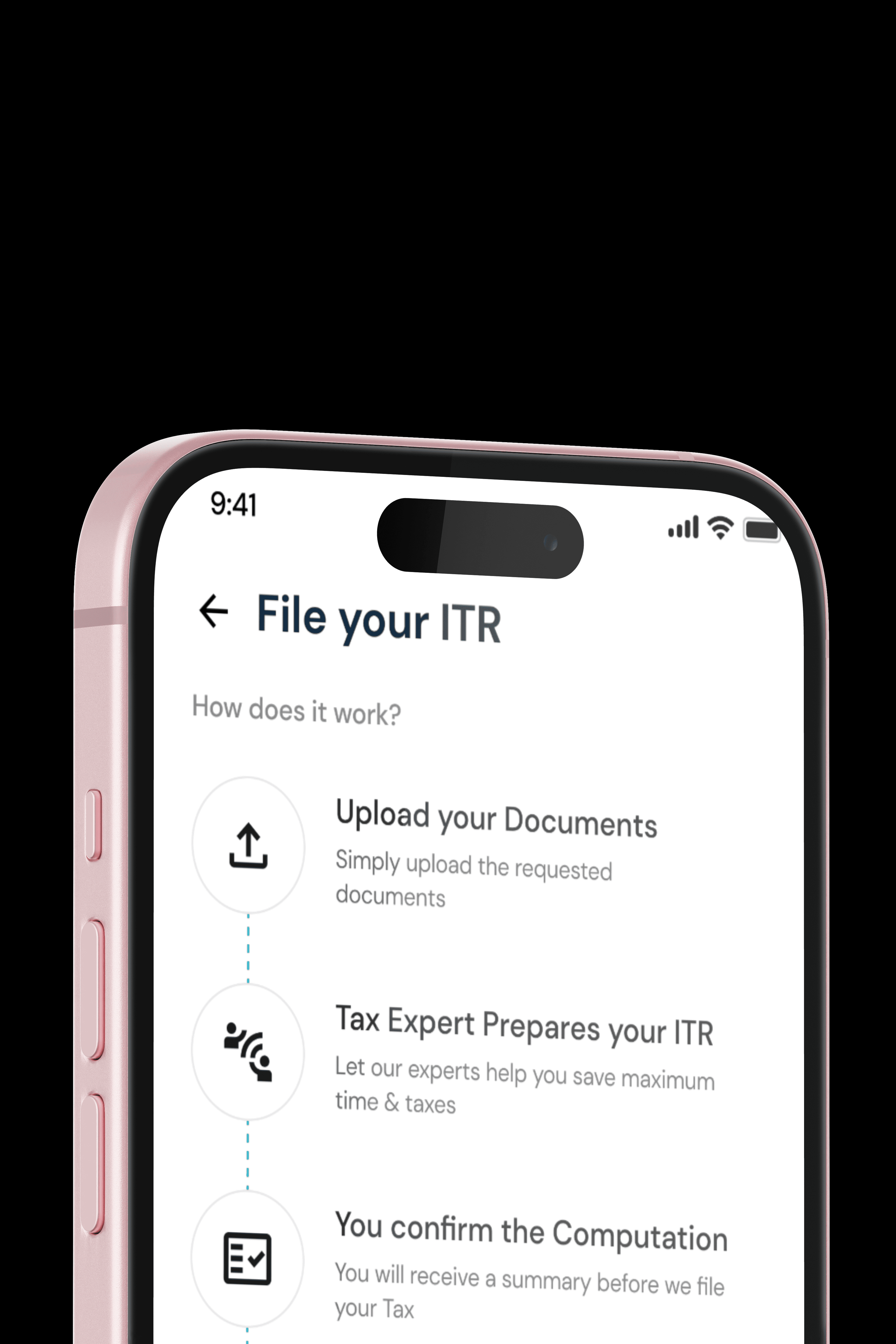

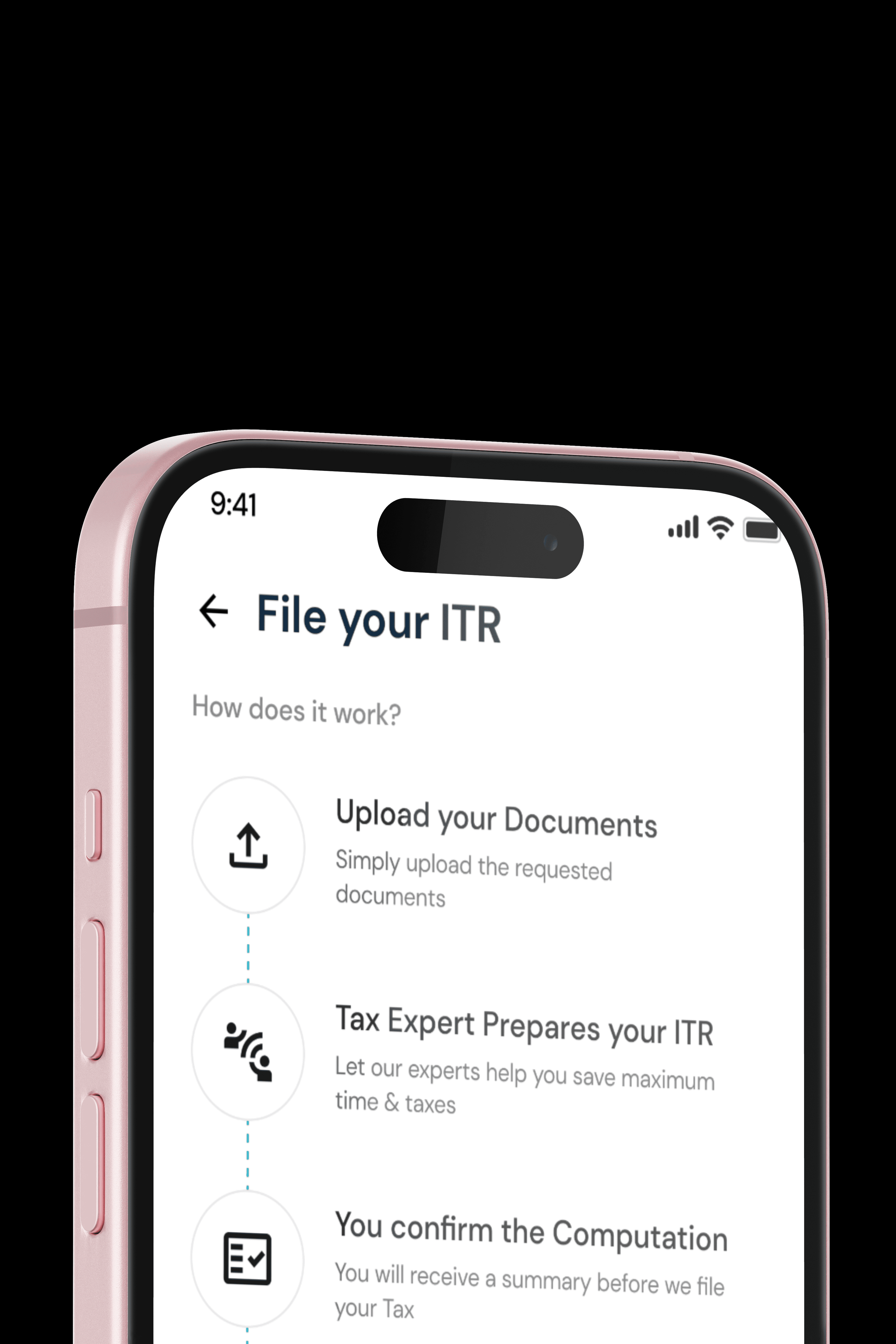

Reduce Drop-Offs, Build Trust: Redesign TaxBuddy's ITR Filing with a seamless chat experience empowers users and builds confidence in expert guidance, increasing chat interactions for tax and reducing calls.

Company

TaxBuddy

Domain

Online Tax Filing & Advisory Platform

Industry

FinTech

Timeline

7 months

Team Size

3 UX Designers

2 Visual Designers

Role

UX Research & Analysis

What is Taxbuddy?

Taxbuddy is a platform that helps you plan and file your taxes online. They have partnered with Tax Experts and CAs that assist you on their website and app.

Scenario

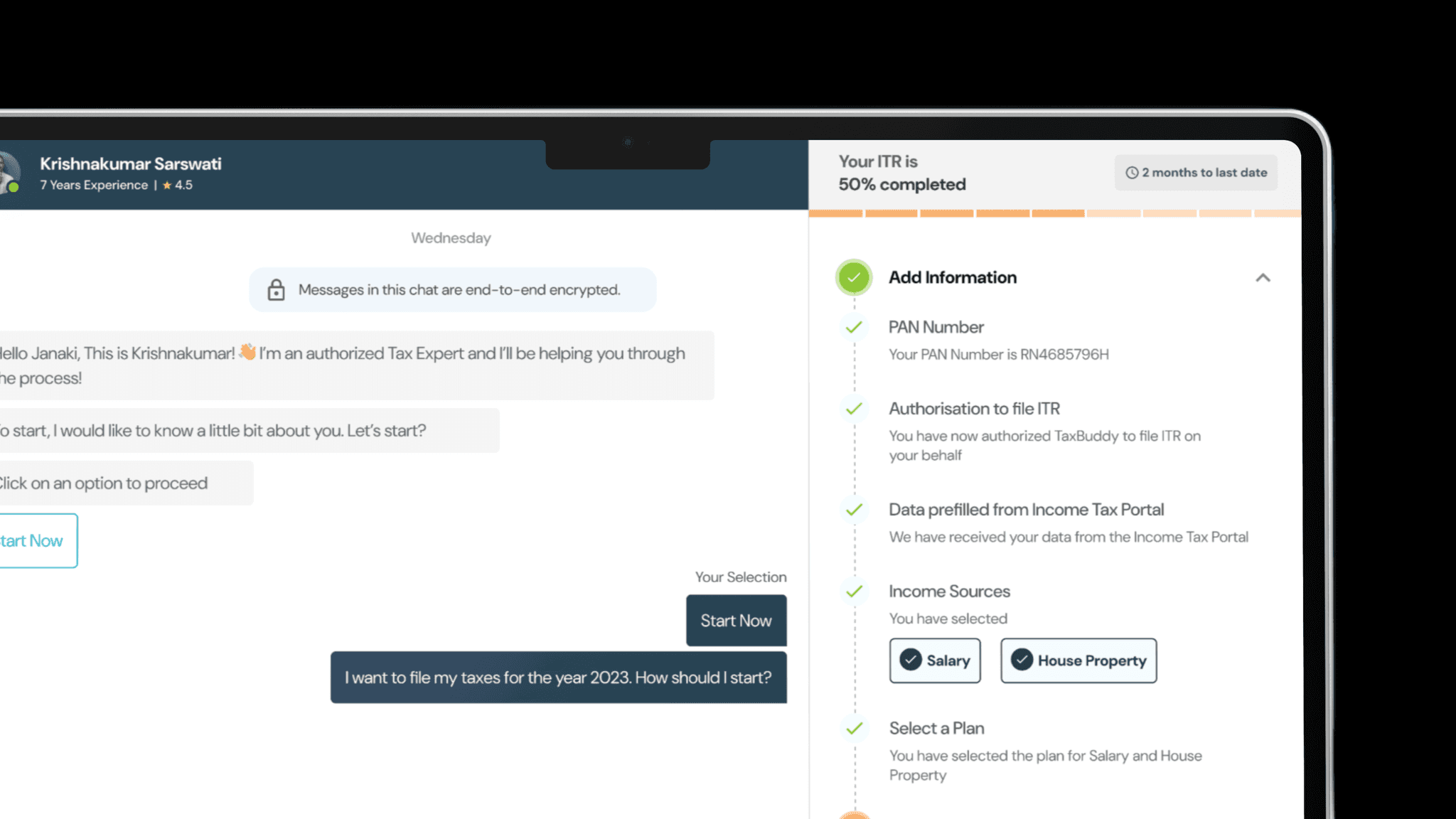

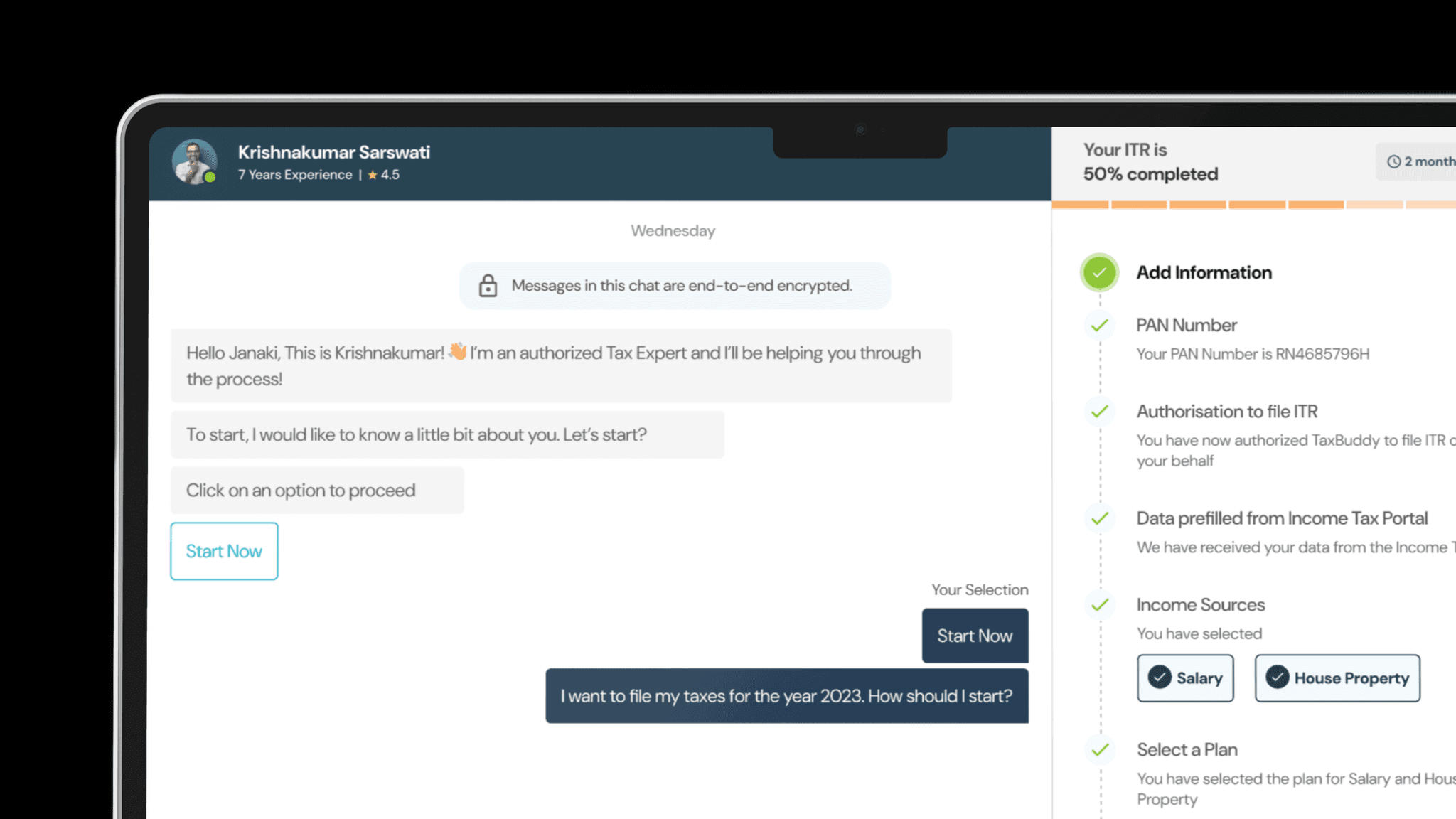

The current ITR Filing process on TaxBuddy involves a chat interaction between the client and the tax expert, partially facilitated by an AI bot.

Challenge

TaxBuddy's current ITR filing process exhibits a significant user drop-off rate from the chat interface to phone-based interactions with tax experts. Indication that the chat-based system is not effectively meeting user needs and expectations.

Results

Enhanced User Experience and Trust Through Chat- A redesigned ITR filing process which is entirely chat-based and reduced call interactions between the client and tax expert. The redesigned ITR filing process has successfully transformed the user experience, building trust and increasing reliance on the chat platform.

18%

Time spent on the website

23%

Increase in user retention

36%

Drop in number of phone calls

Let's break it down.

Taxbuddy uses a chat to gather documents to file taxes, but many of them end up calling the tax expert instead.

The problem is that there aren't enough experts to help everyone. So, the chat is partially driven by AI. We need to find a way to make chatting with TaxBuddy feel so real and helpful that people don't feel the need to call.

Desk Research

Research Reports

Competitors Analysis

I found myself lost in a world of tax jargon and complex regulations.

Individuals (53.4M) account for the vast majority of ITR filings for the financial year 2022-23.

There's a significant preference for online ITR filing, with 55.2M returns filed online compared to just 3.1M filed offline.

There's a “Demand-Supply Gap” of Tax Advisories in India, also within the company. In simpler words, There's 1 Tax Expert for 12 people.

User Research

Survey

Interviews

Our mission was clear: Understand why users were dropping the chat for phone calls.

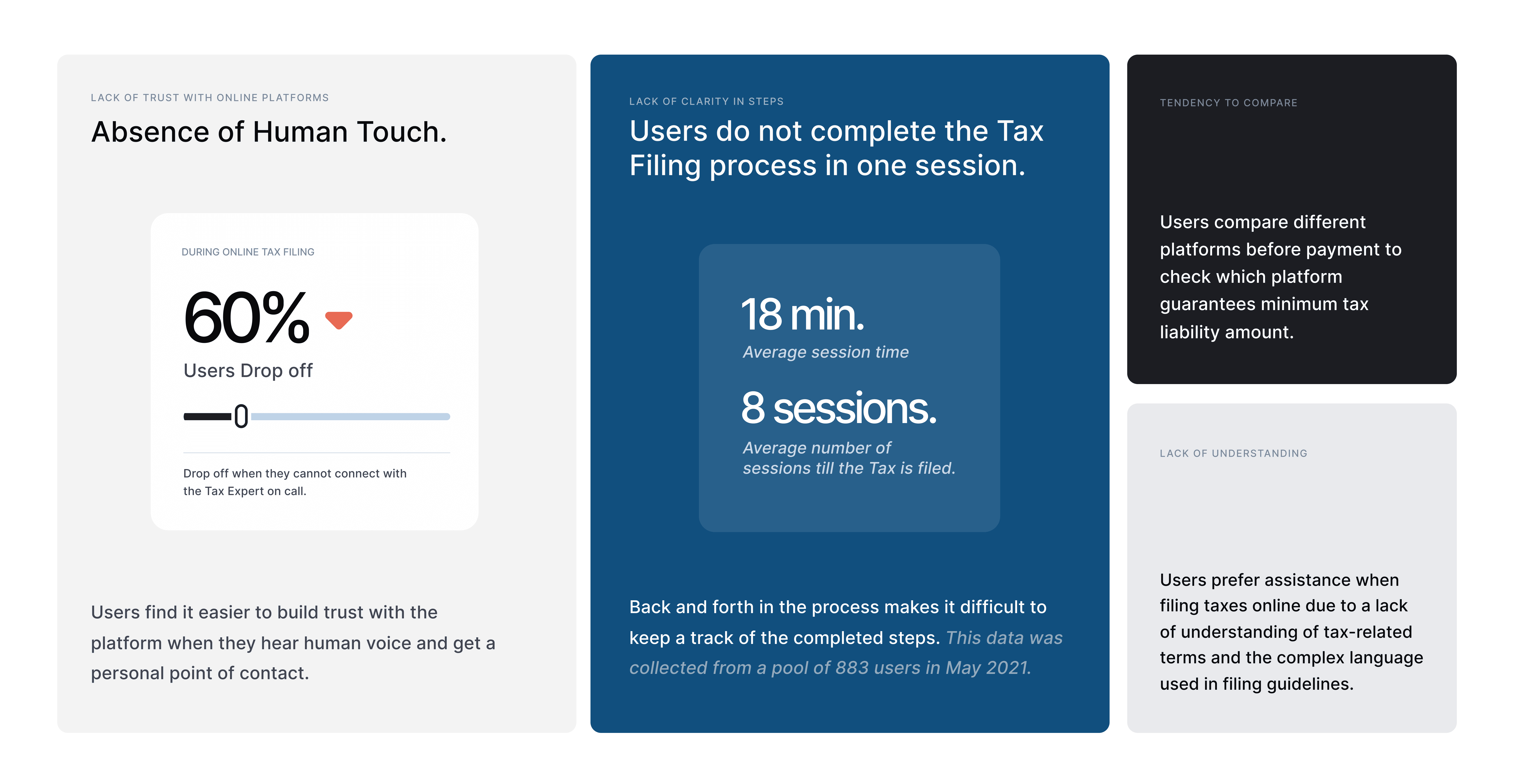

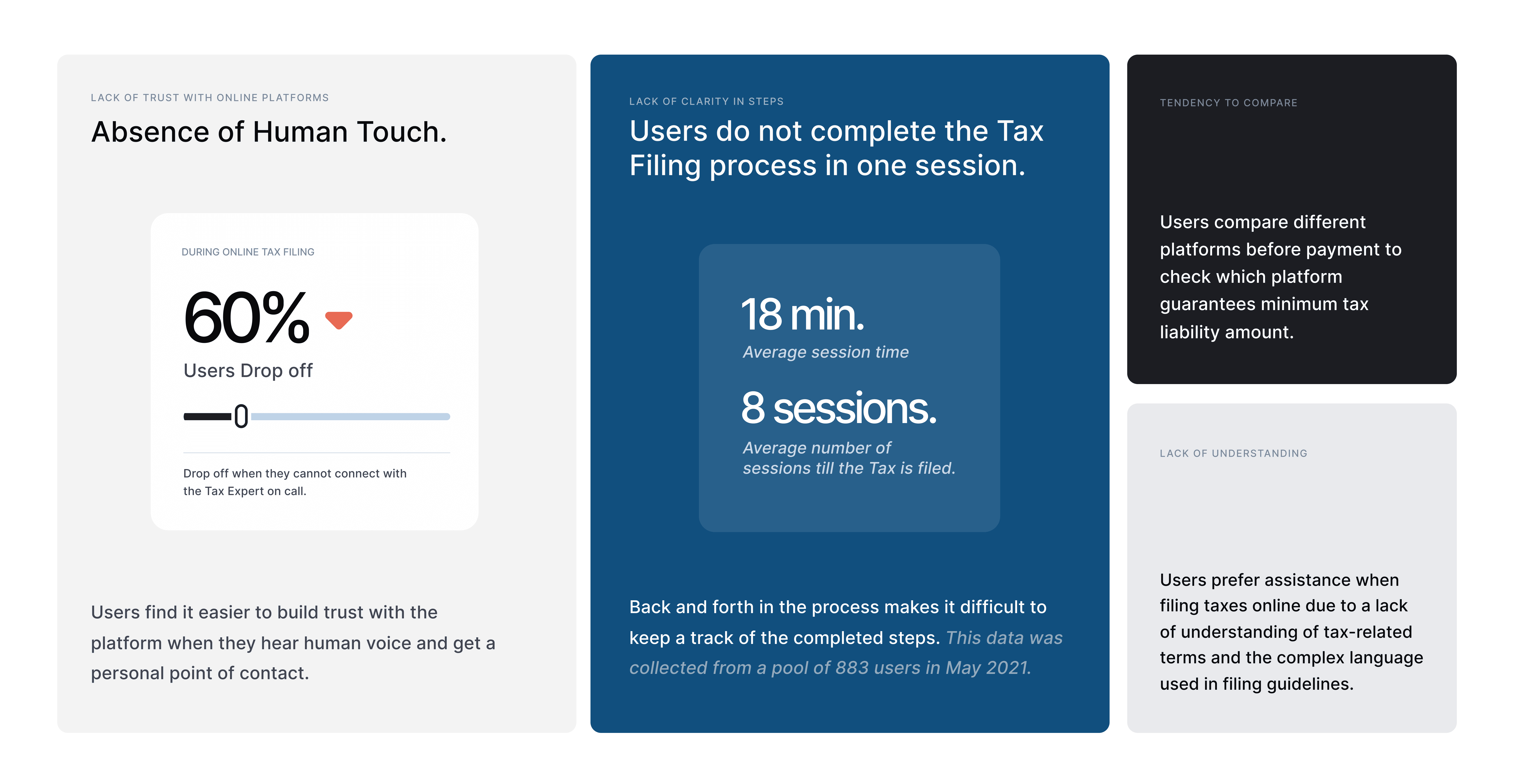

Users expressed a strong preference for interacting with a human agent.

Easier to establish trust and build rapport through verbal communication.

The intricate nature of tax filing, coupled with the use of complex language and terminology in guidelines, often overwhelmed users, leading them to seek assistance from a live person.

"I don't want to upload any document related to my work because I don't trust it enough. Atleast at that point"

"Honestly, I do not understand half the things. I just started filing my taxes and I'd like someone to support me"

User Analytics

Conversion Funnel

Time on Task

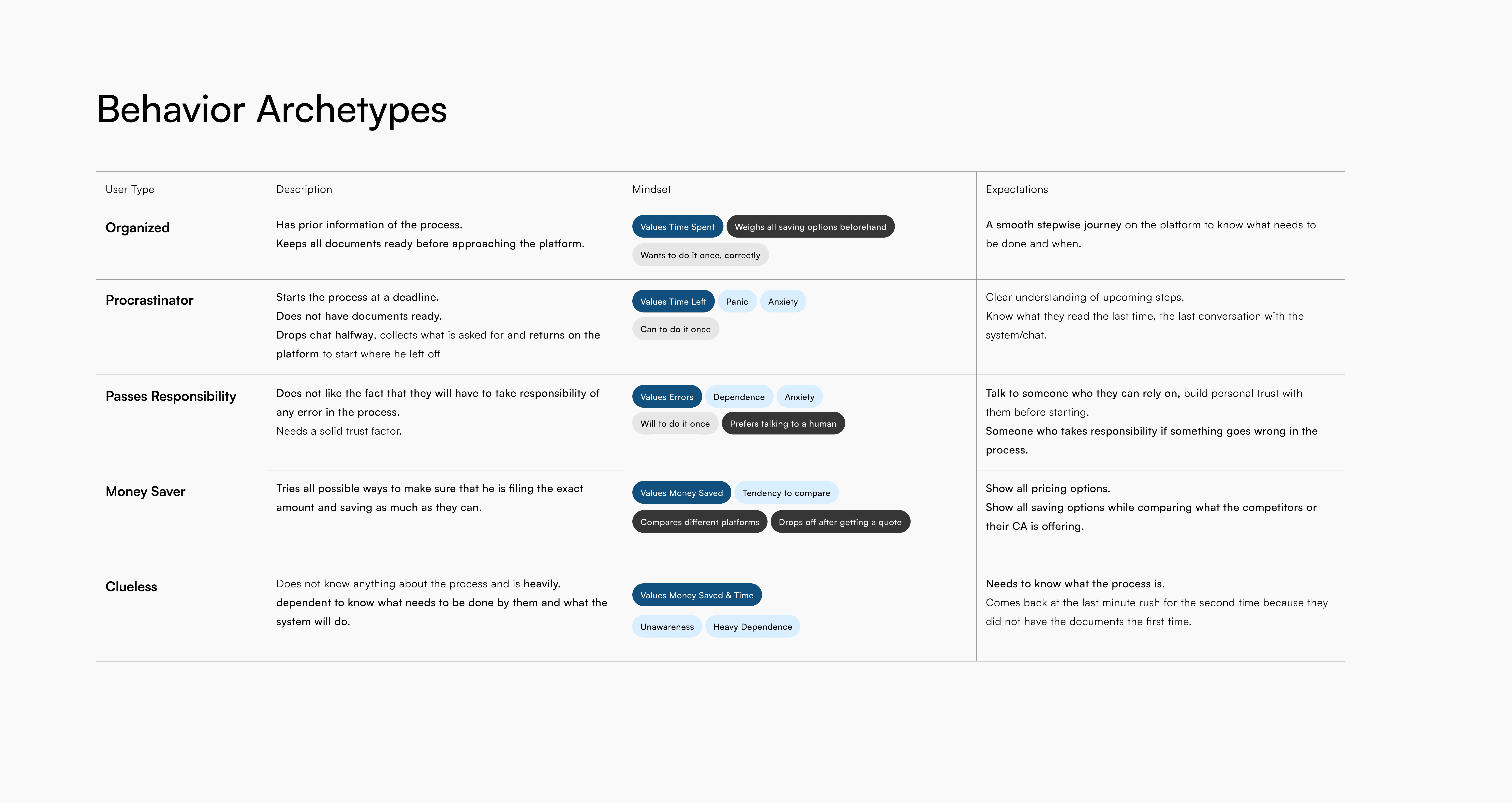

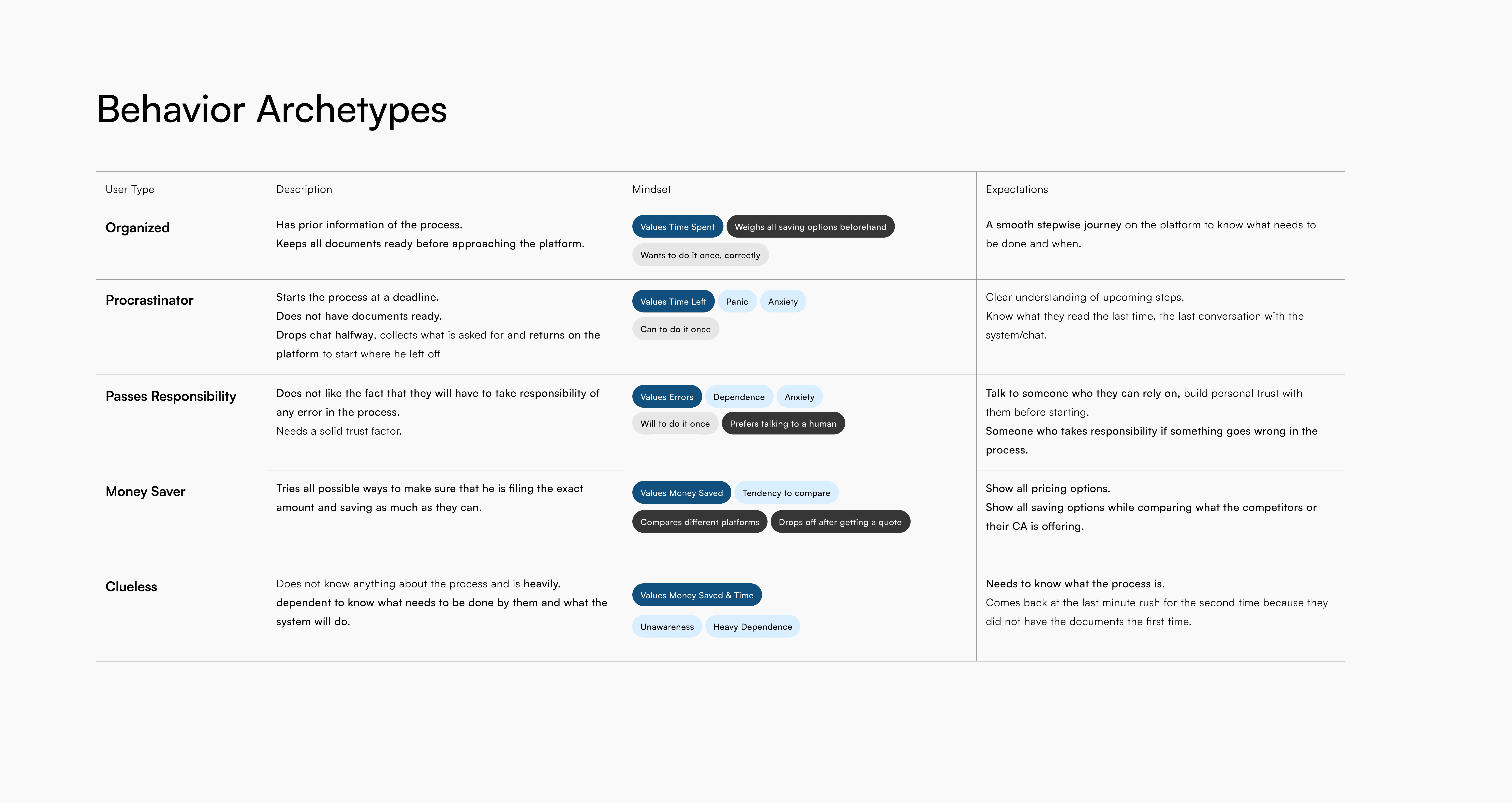

Behavior Archetypes

We had their thoughts. I wanted this to be backed up with numbers.

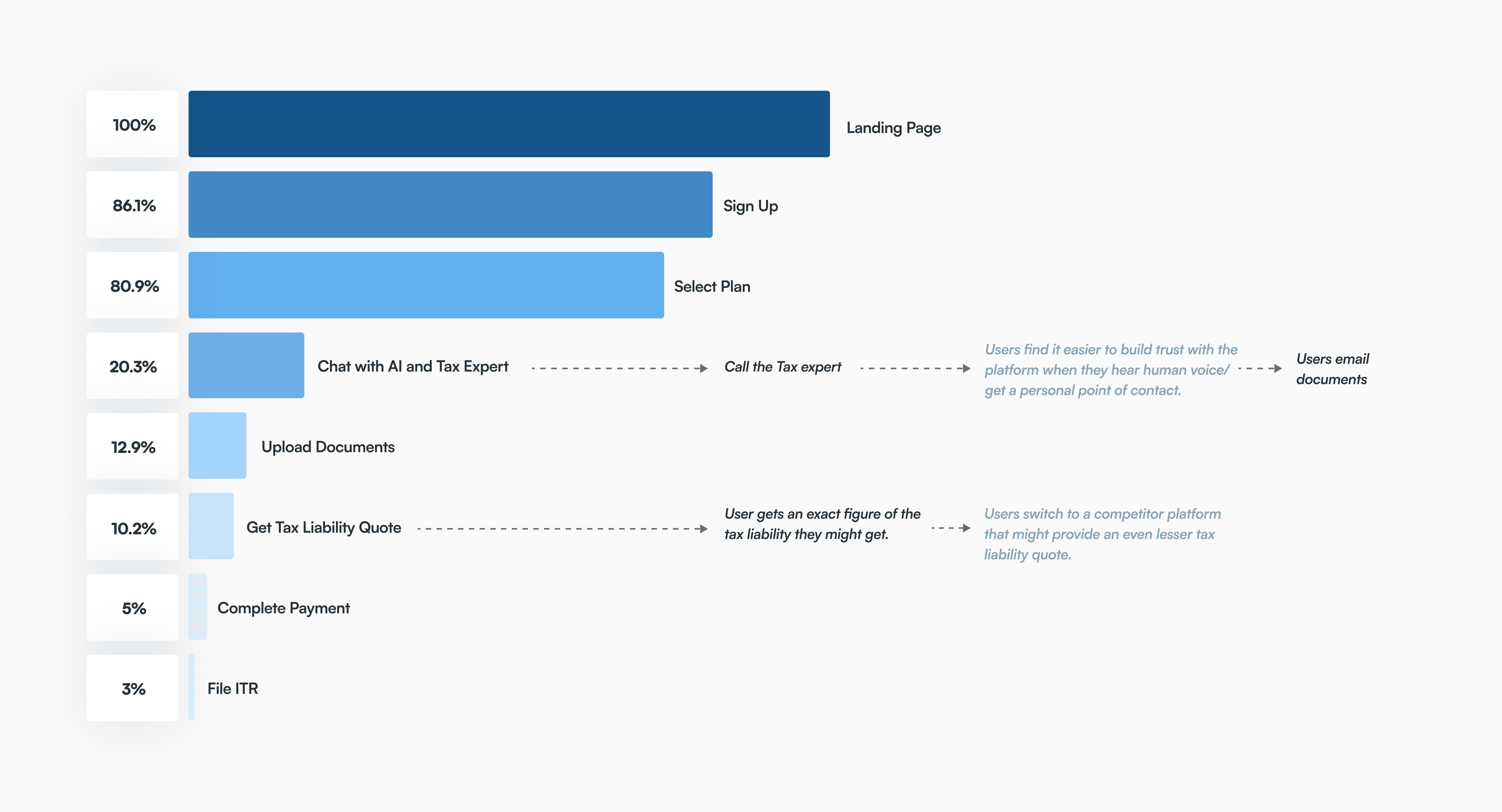

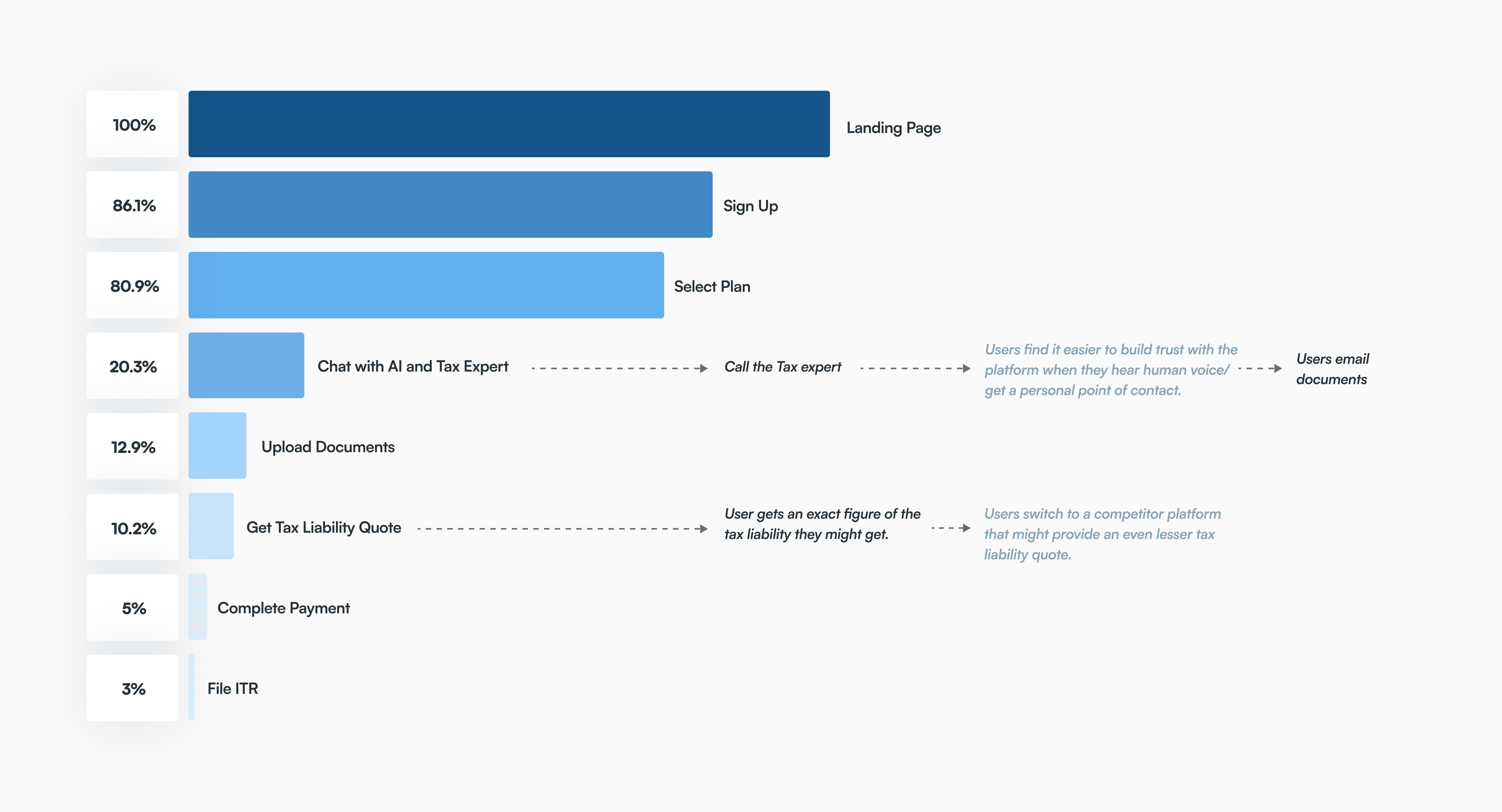

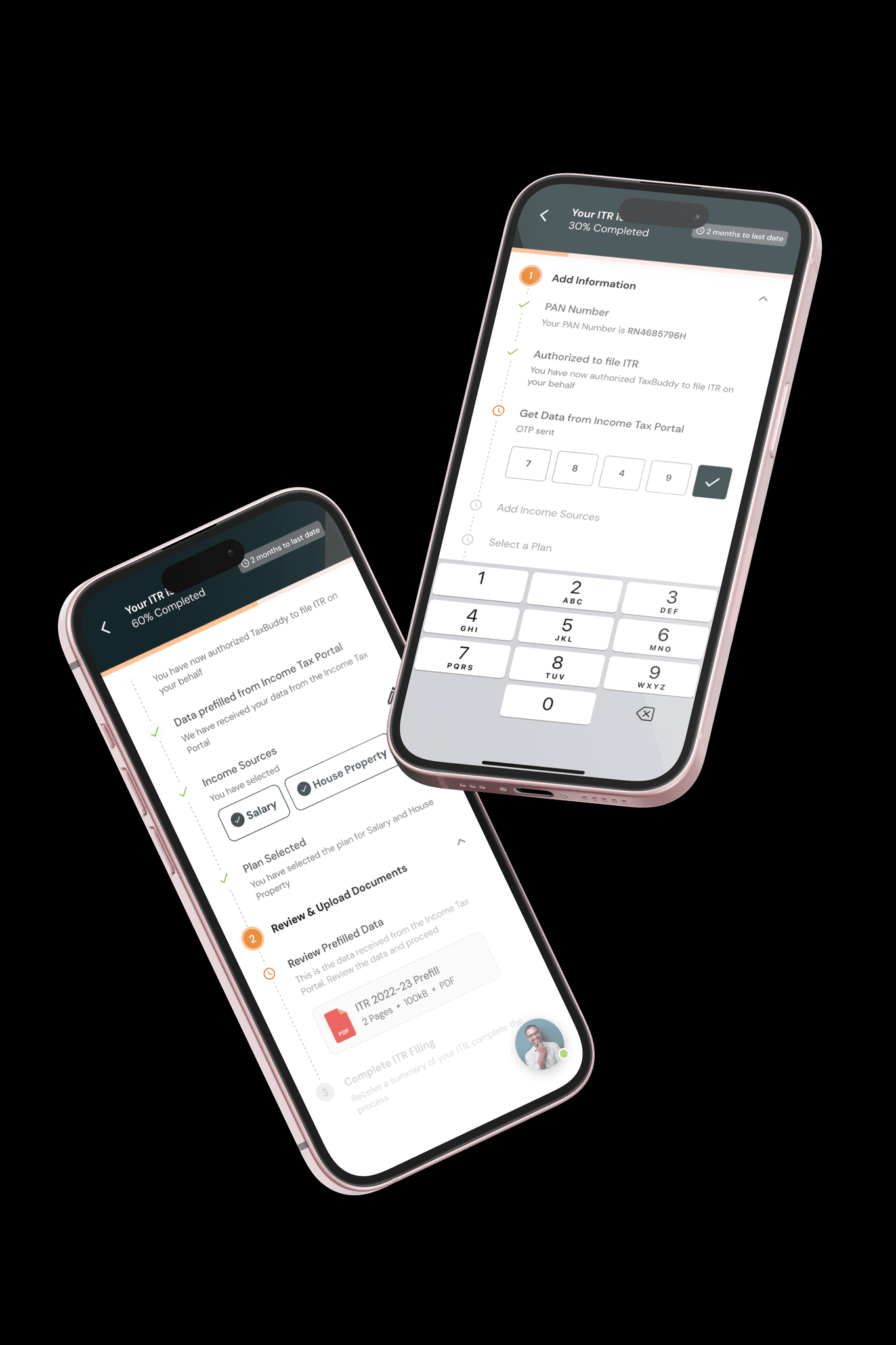

The funnel exhibits a significant drop-off between the "Select Plan" and "Chat with AI and Tax Expert" stages. This is the most critical point of leakage in the funnel. Absence of Human touch could be a major contributing factor.

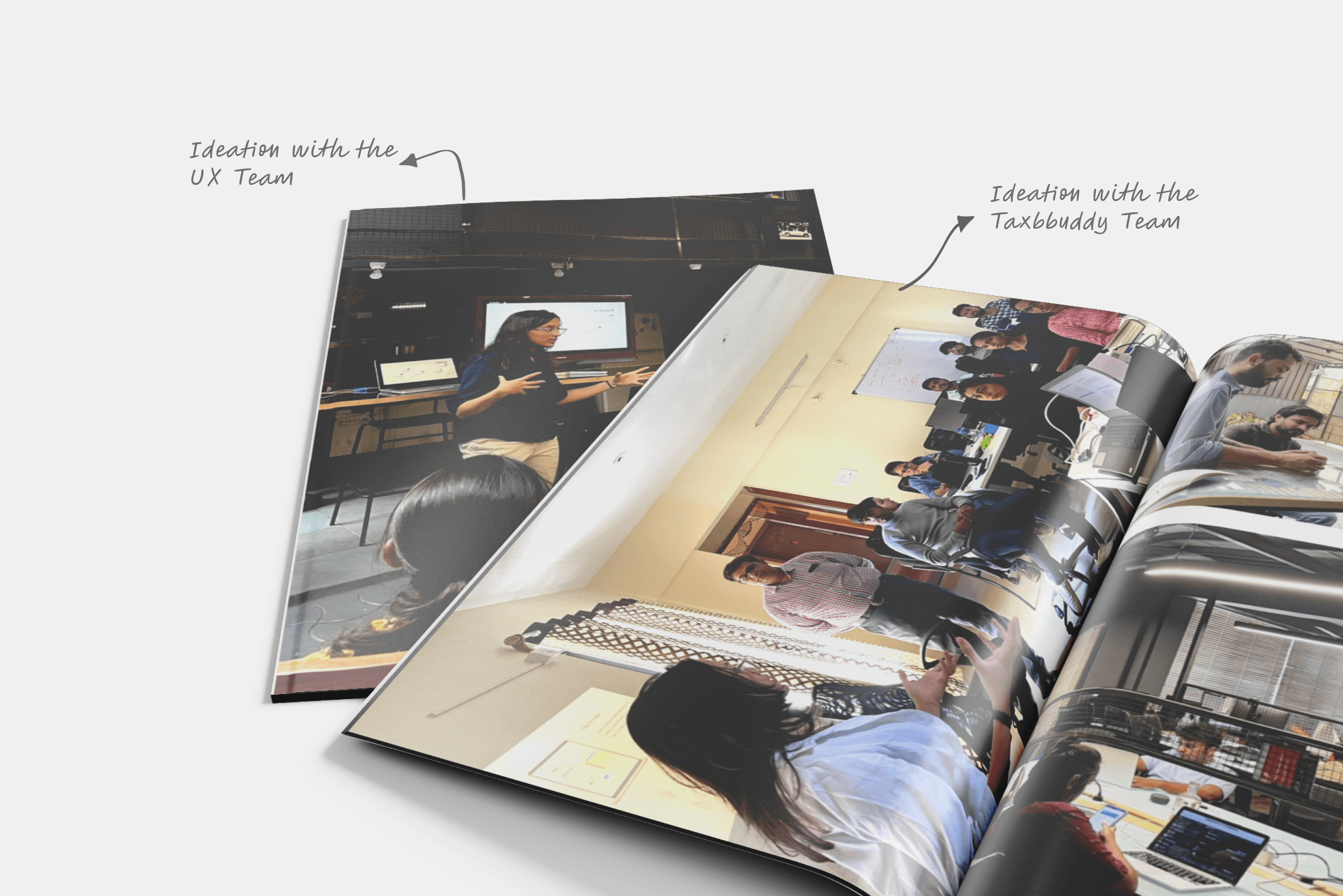

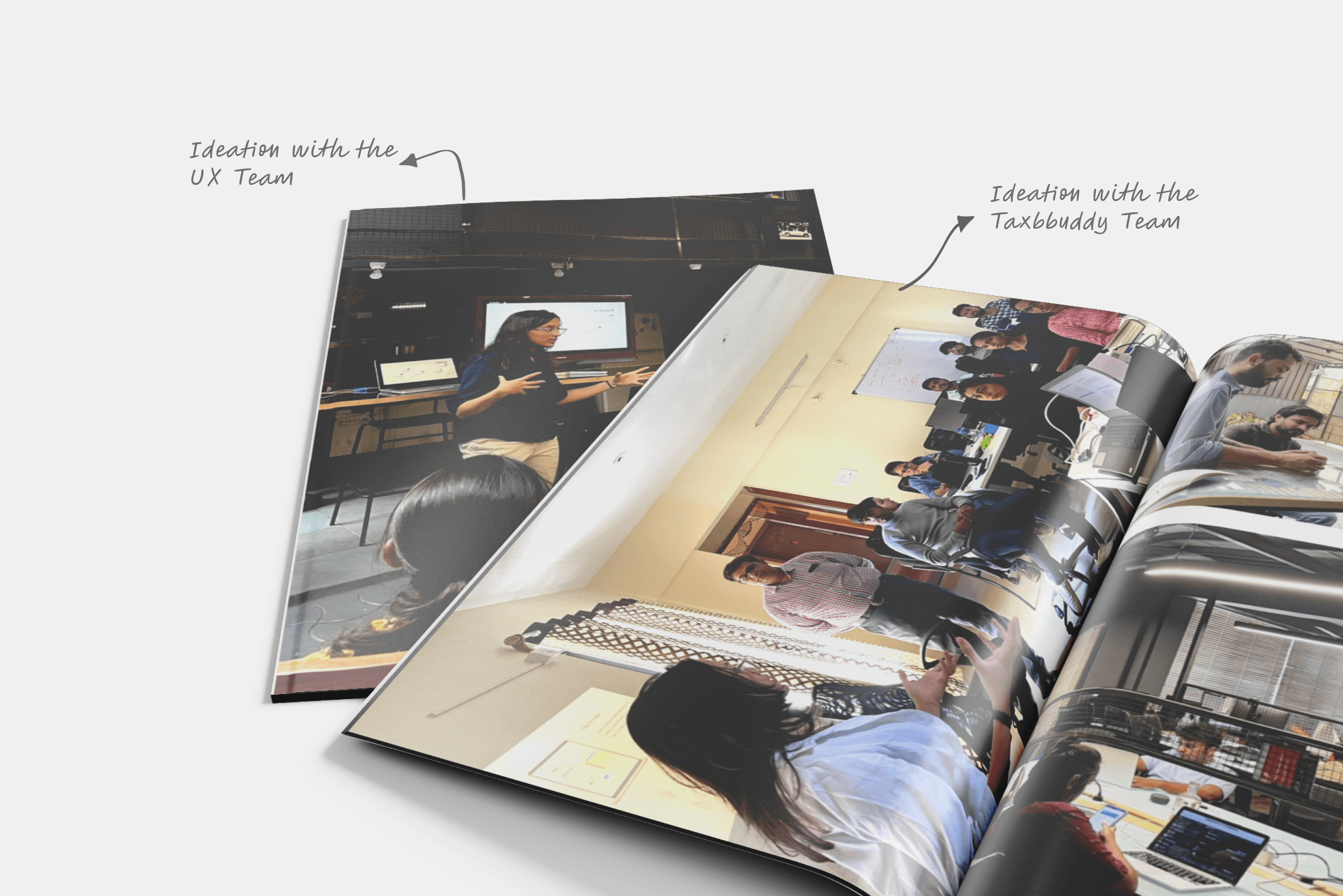

Brainstorming & Ideation

Whiteboarding

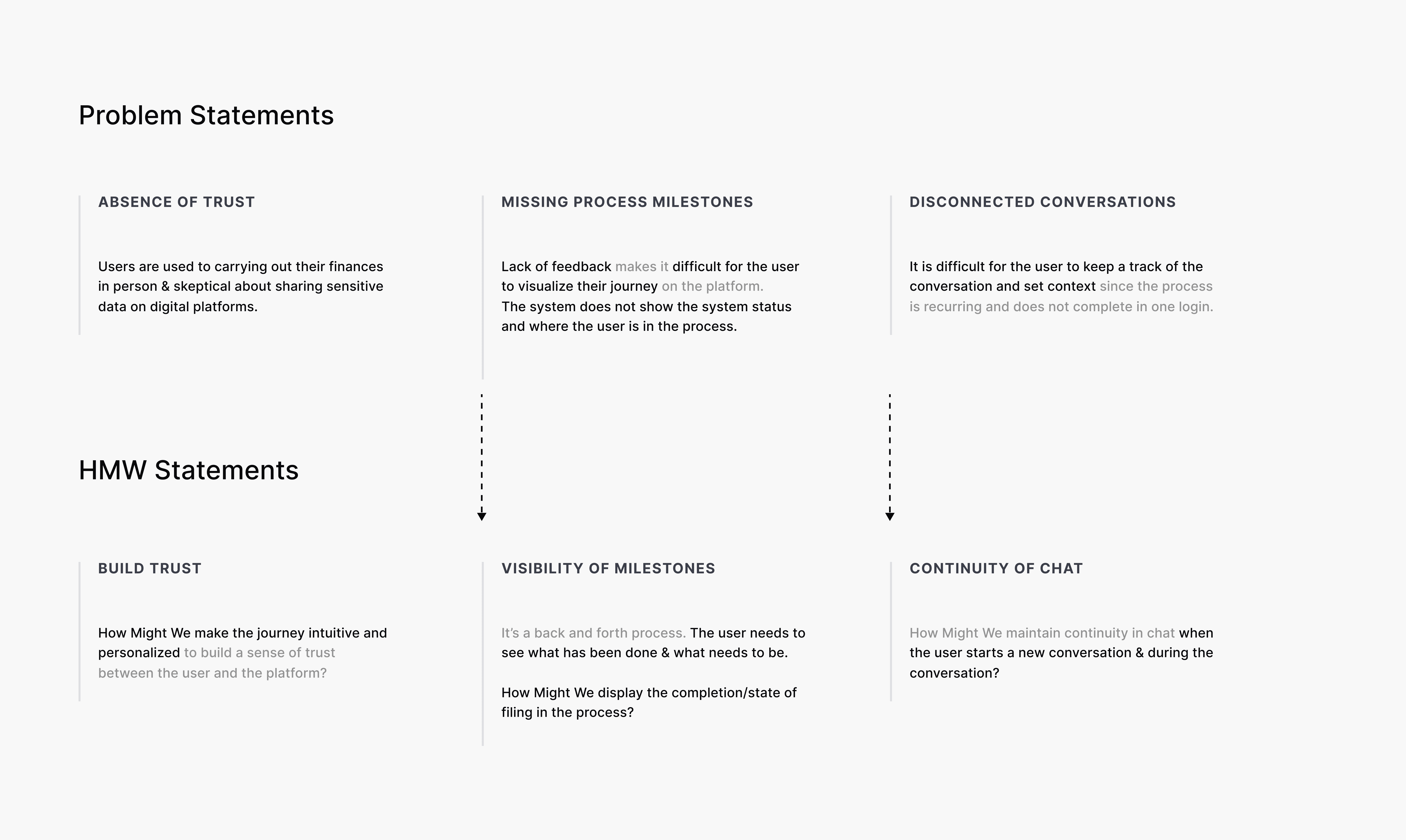

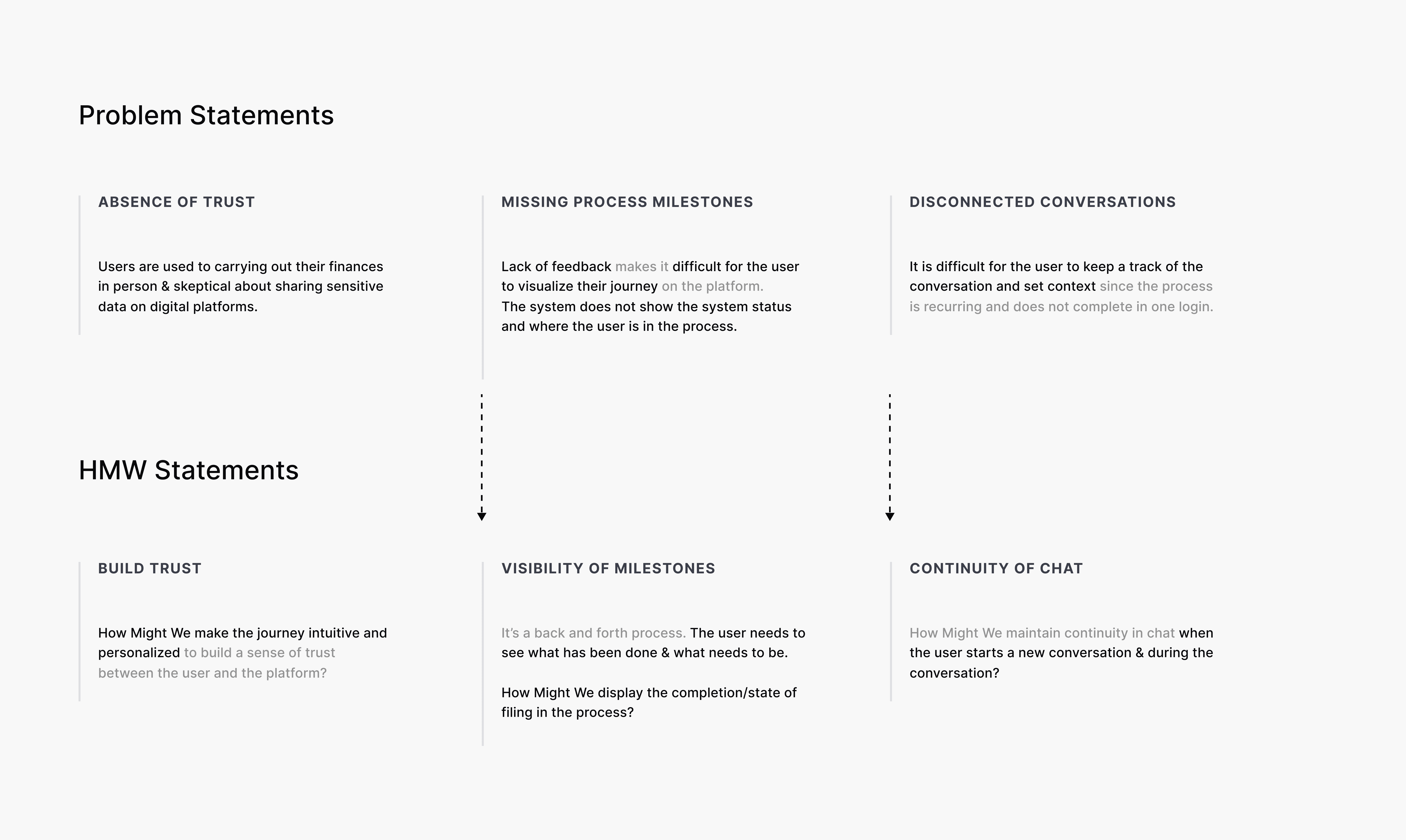

HOW MIGHT WE

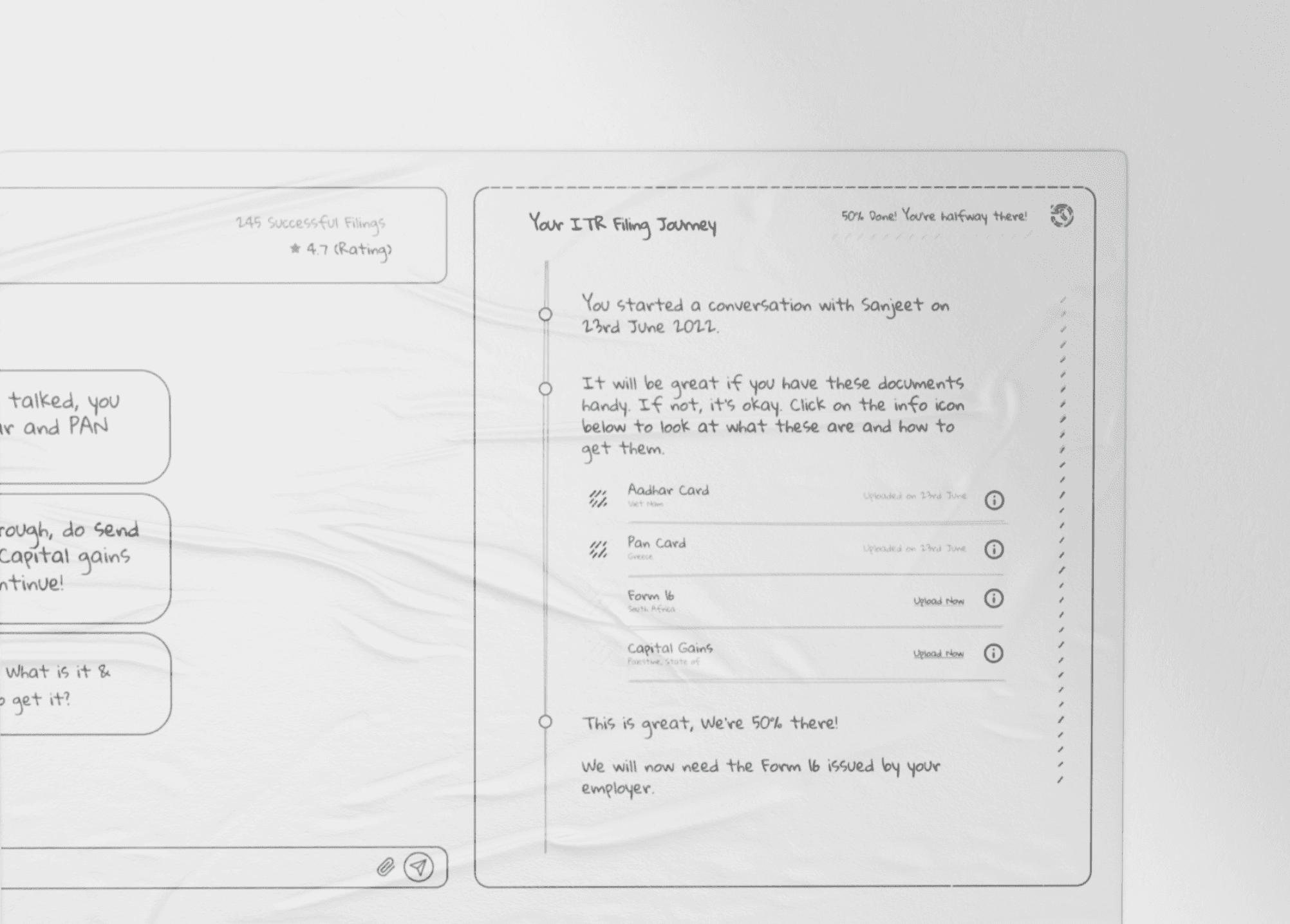

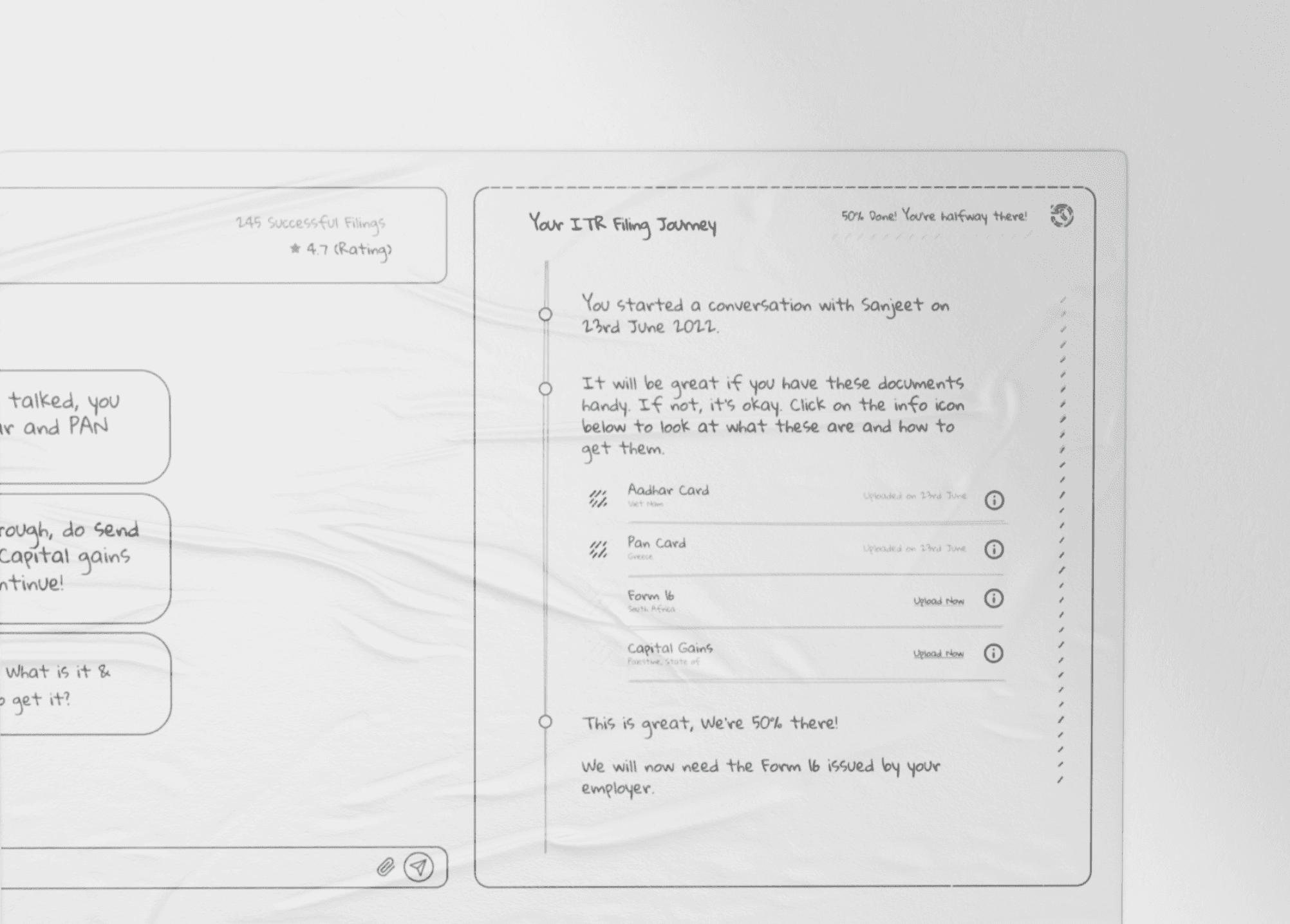

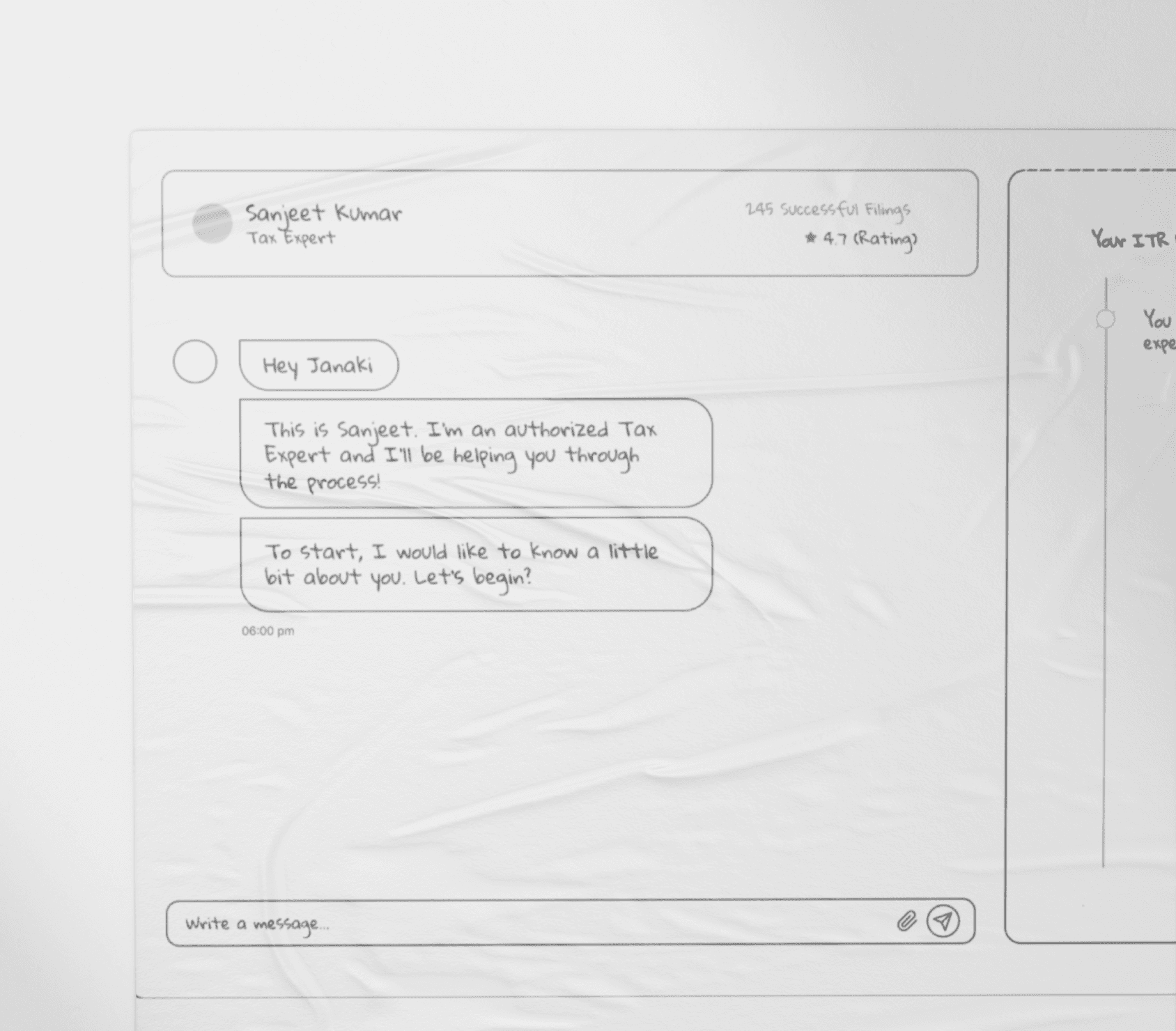

Low Fidelity Wireframes

We could've just replaced the chat feature. But, this issue needed a fix, not a replacement.

Our process focused on identifying key areas for improvement within the chat experience.

The funnel exhibits a significant drop-off between the "Select Plan" and "Chat with AI and Tax Expert" stages. This is the most critical point of leakage in the funnel. Absence of Human touch could be a major contributing factor.

IDEA #1

Split view of Chat and Summary

Timeline

Milestones

Display a timeline of previous actions and milestones. Clearly show what has been done and what has to be done.

IDEA #2

Credibility and Tone of Voice

Years of expertise

Number of successful filings

Show the user that the person they're talking to is credible and qualified. Set a friendly tone of voice.

IDEA #3

Context of Conversation

Checklist

Expected Journey

Tell the user what their last conversation with the expert was. Show where they left off.

Voices from the Process.

"Initially, we believed that the solution to TaxBuddy's chat difficulties was to replace it entirely with a more structured form-based experience. We thought this would streamline the process and make it easier to track and manage."

"Halfway through the process, we realized we we'ren't solving the problem at all"

We realized that our initial solution was heading in the wrong direction. We had to go back to the drawing board and focus on enhancing the existing chat experience rather than replacing it entirely. The challenge was clear: how could we make the chat feel so real and helpful that users wouldn't feel the need to escalate to a phone call, especially given the limited availability of tax experts?

For the best experience, open the website on a Desktop or Tablet.

UX Researcher & Designer with a passion for user-centered design. Skilled in data collection, testing, and analysis to inform product development. Driven by a relentless curiosity, I explore the intersection of human behavior and digital products.